The Charity Initiative: Flow-Through Shares and Philanthropy

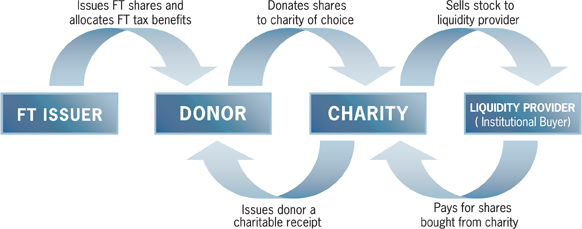

For individual and corporate donors making substantial charitable donations, we recommend the Ber Tov Flow-Through Charity Initiative (the “Charity Initiative”). By combining the tax benefits of (a) the purchase of flow-through shares with (b) the subsequent donation of the shares, the Charity Initiative significantly reduces the after-tax cost of charitable donations while eliminating the risk of a decline in the share price of the flow-through shares.

Before a client commits to a particular transaction, we arrange for a liquidity provider – typically, an institutional investor – to purchase the shares from the client’s intended charity at a pre-determined price. Therefore, the charity receives the intended donation amount in dollars, and changes to the market price of the shares do not impact the amount of the donation.

The Charity Initiative is generally suitable for Canadian accredited investors only.

To learn more about the Charity Initiative and to discuss the impact of the Charity Initiative based on your own personal circumstances (including province of residence, income and tax characteristics), contact us.

To learn more about the Charity Initiative and to discuss the impact of the Charity Initiative based on your own personal circumstances (including province of residence, income and tax characteristics), contact us.

The Donation Hybrid Approach: Combining Transactions to Further Reduce Cost of Giving

We view the Charity Initiative and Share Initiative as distinct strategies. However, many of our clients combine the two strategies to further lower the after-tax cost of a donation.

The Hybrid approach combines the two strategies. By offsetting the cost of the Charity Initiative with the return from the Share Initiative, a participant can reduce the after-tax cost of the donation significantly below the levels of a stand-alone Charity Initiative.